One way to reduce fossil fuel in products is to, as suggested by The Swedish Sustainable Economy Foundation, introduce a progressive tax and dividend on fossil fuel.

Continue reading “The Tax and Dividend mechanism. A simulation”Author: stephenhinton

Introducing the Business of Peace Podcast – Investors in Peace

We wouldn’t be doing this if peace were not a thing. We know it is. But few seem to be talking about it. So we decided we should.

Continue reading “Introducing the Business of Peace Podcast – Investors in Peace”Trying out a water walk

One possible round route of 4 km following the river Lugneån that feeds into the river Hoån and the hydroelectric installation that provides Hofors with electricity.

Rivers are held as sacred in India. It is not uncommon for people to undertake long pilgrimages to walk from their source to the sea. The People’s Water Commission on Drought and Floods, https://pwcdf.org/ an NGO co-founded by the International Association of Advanced Materials, based in Ulrika, Sweden, has had the idea, inspired by the Indian example, that people in their local areas set up a water walk to better engage with the water systems in their local areas. One of the main purposes would be to engage people in preparing for possible droughts and floods as the climate changes.

Continue reading “Trying out a water walk”UK water industry is environmentally insolvent

This is something for investors in peace with the Earth: the concept of environmental insolvency. It happens when a business creates an environmental liability (in this case, when water cleaning activities pour sewage into rivers and coasts requiring massive reparations). This liability comes when the operational contract requires restitution and the firms do not have enough assets to fund the restoration and upgrade.

Continue reading “UK water industry is environmentally insolvent”Want to take part in the UBI simulation game online?

Our UBI simulation game has been going awhile and every time it’s played is a new experience and new learning for participants. This is because – like all games – there are several factors interacting at the same time. Think UBI is all good – all bad? When you play the game you will see that even with simple factors to adjust, economics gets complex when humans are involved.

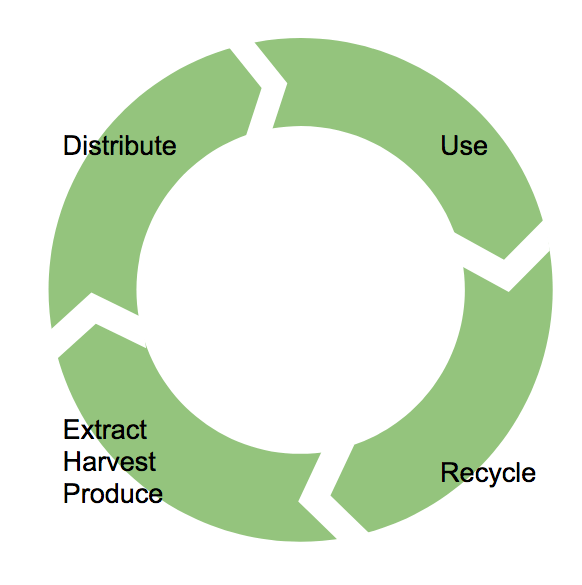

Continue reading “Want to take part in the UBI simulation game online?”Supply chain modifications to run sustainably and circular

This video describes the types of industries that make up supply chains, and points at the areas where they need to adapt to circularity and sustainability.

Video tutorial: system dynamics and economics of the circular economy

The decision basis most policy makers have to go on are overwhelmingly economic data. This is needed but economics is far from being a science. For one thing, the units economists use are much less concise than those of physics, biology etc. For another, the world would continue without economists. Science-based professions, like engineering and medicine, would stop working without its science-based practitioners.

Is it possible to create a rational decision basis using metrics other than money? Can this be presented in a way that will help decision-making? Especially decisions about transition to a circular economy?

Contents:

- System dynamics applied to real capital, its status, capacity and thresholds.

- How to connect the firm’s infrastructure with environmental and social performance and investment needs.

- The Assets – Liabilities- Equity approach to clarify and quantify the firm’s affect om real capital, especially natural capital. Even of the total production system on nature and society for any geographical area

- A normative approach for capital status producing a solid decision basis for the three areas of sustainability – Economic, Social – Ecological.

I need help to make these threads better. Feel free to comment below.

WAFA Awards winners to be announced online Thursday the 15th June

Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.

A post-growth Woodstock moment

It wasn’t Yasgur’s Farm, they went one better. Filling the EU parliament with multi-stakeholder representatives from all over Europe and beyond, speaker after speaker talked alternatives to basing society on economic growth.

The Woodstock likeness is fitting: a moment where many gather and co-create around a new way of thinking. If Woodstock was a defining moment for a counter culture generation, Beyond Growth similarly redefined the role of economics as no longer the only kind of music governments sing. Wellbeing, equity, care for the Earth, sufficiency were blasted out from the stage. For three whole days.

Continue reading “A post-growth Woodstock moment”Investors in Peace newsletter: worth a look!

Investors in Peace newsletter has been going for a while. Here are some highlights:

The philosophy of the Circular Economy is really the philosophy of Peace with the Earth. Read why it’s important here. And the first principle is described here.

The business of business is Peace. By putting Peace first, the rest comes easier. Read the introduction and the deeper explanation why Peace is the biggest opportunity.

And what about creating a culture of peace. The time is right to think about a new world. What would a culture of peace look like? Can we measure how peace-promoting our culture is?

Catch all the editions of the newsletter at investorsinpeace.substack.com