In the face of ecological degradation, infrastructure stress, and social fragility, national budgets remain mired in outdated accounting frameworks. They report in money terms only, largely ignoring the real capacities that sustain economic life. But what if we treated the productive and regenerative capacities of Real Capital—ecosystems, infrastructure, human health, and institutional systems—as central to budgeting itself?

This is the message of the parody cartoon above: that keeping track of money as budgets, and then balancing them misses the point by far. You need to be looking at what the economy is for. And the productive capacity in place. Without the capacity you cannot get the performance.

Asset-Liability-Equity (ALE) tables, familiar to economists and decision-makers, offer an elegant vehicle to do just that. By inserting the democratically agreed capacity and function of Real Capital into the “Asset” column, ALE tables can finally reflect the full scope of what underpins national well-being and resilience. This proposal not only deepens democratic accountability—it aligns with the insights of Modern Monetary Theory (MMT) and contemporary systems thinking.

1. Budgets Currently Omit What Matters Most

Standard budgeting frames spending in purely financial terms: revenues, deficits, outlays. But such abstraction hides what society is actually investing in—or failing to. If forests degrade, if water becomes undrinkable, if children go uneducated, or if transport breaks down, national accounts might remain “balanced,” but society itself does not.

These are not merely “externalities.” They are failures to maintain Real Capital, the very substrate of continued functioning. And yet, the official ledger says nothing of their deterioration until it translates into monetary loss—often too late.

2. Real Capital Is Quantifiable—and Budget-Relevant

As I have argued earlier, Real Capital can be quantified in terms of capacity and function. Forests can be evaluated for their biodiversity and carbon cycling; hospitals for service capacity; energy systems for resilience and throughput.

When these capacities fall below thresholds necessary for long-term societal functioning, they represent a liability—a gap between what is and what must be, if policy objectives are to be met. Conversely, where Real Capital is healthy and functioning, this should be recorded as an asset—a capacity already in place (and invested in) to meet collective needs.

3. Democratic Normatives Define Capital Targets

Crucially, Real Capital targets should not be technocratic guesses—they should be normatively defined. In a democracy, this means referencing laws, policy goals, and societal values: for example, “zero homelessness,” “net-zero emissions by 2040,” or “universal education.” These commitments represent desired future capacities, and ALE tables can operationalize them as target asset levels.

Thus, the Asset column in ALE becomes not a record of what exists, but a record of what ought to exist—the capital capacity necessary to fulfil national goals.

4. Why ALE Tables Are Ideal

ALE tables are used to track organizational health—what is owned (Assets), owed (Liabilities), and left over (Equity). Adapting this structure to Real Capital:

- Assets = The target capacity of Real Capital (based on democratic goals)

- Liabilities = The current shortfall or degradation from that target

- Equity = The functioning capacity currently available to meet national needs

This approach immediately highlights where investment is needed, where overuse or degradation has occurred, and where functioning systems can be relied upon. It links scientific, ecological, and social realities with budgetary thinking—without relying on speculative monetary valuation.

5. The MMT Perspective Supports This Shift

Modern Monetary Theory (MMT) reminds us that money is not the constraint—real resources are. Governments that issue their own currency can always afford to fund what is physically and socially possible. What they cannot afford is the decay of real productive systems.

Thus, from an MMT standpoint, it makes perfect sense to budget against real capacity, not financial abstraction. ALE tables allow us to do this: to ask, for every policy goal, do we have the Real Capital to meet it? If not, how far short are we? And what does it take to regenerate that capacity?

6. Toward Regenerative Budgeting

Embedding Real Capital into ALE tables would transform budgeting into a forward-looking, systems-aware process. It would make capital regeneration—not just expenditure—central to public financial discourse.

Imagine a budget report that not only lists spending lines but includes tables showing:

- The ecological maturity of key ecosystems

- The sufficiency of housing stock by region

- The performance gap between current and best-available infrastructure

- The carbon sequestration shortfall relative to climate targets

Such a report would empower voters, legislators, and planners alike to see clearly where the national system stands, and what needs to change.

Worked example

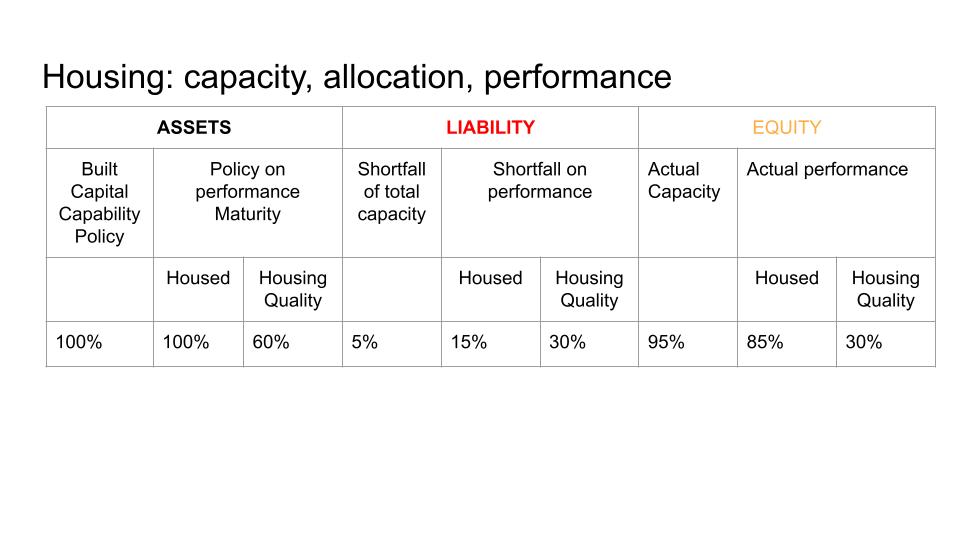

The table above shows how to construct ALE tables for Real Assets with budgets or policy objectives in the Asset column. In this case, the aim is for 100% capacity – that is to say the housing stock matched the number of family units. And the policy is to have 100% actually housed (allocated) and a housing quality aim of 60%. (To give a simple example, the number of units with more than a certain m2 per person area.)

The shortfall in capacity is 5%, but allocation has a 15% shortfall. And only half of the housing reaches the desired quality.

The example shows how we can augment monetary budgets with real Capital. In the case above, investment calculations can be made to estimate the cost of closing the gap between policy and reality.

Budgets are moral and material documents. They should reflect not only what we spend but what we care about and intend to preserve or build. By inserting the normative capacities of Real Capital into the Asset column of ALE tables, we make explicit our commitments to human and ecological well-being—not just as slogans, but as accounting entries.

This shift is not merely technical. It is foundational. It declares that our wealth lies not in currency or bonds, but in the systems that keep us alive, learning, moving, and thriving. And only by tracking them explicitly can we steward them wisely.