I am reblogging this post by Dr.Pano Kroko calling for the reform of capitalism. It is high time thought leaders gather to have this conversation. Those of us not fortunate enough to be at the Drucker conference will be with Polly Higgins and Jem Bendell on Mallorca for http://sacredvalleydialogues.org

Author: stephenhinton

Low Oil Prices: Sign of a Debt Bubble Collapse, Leading to the End of Oil Supply?

Oil and other commodity prices have recently been dropping. Is this good news, or bad?

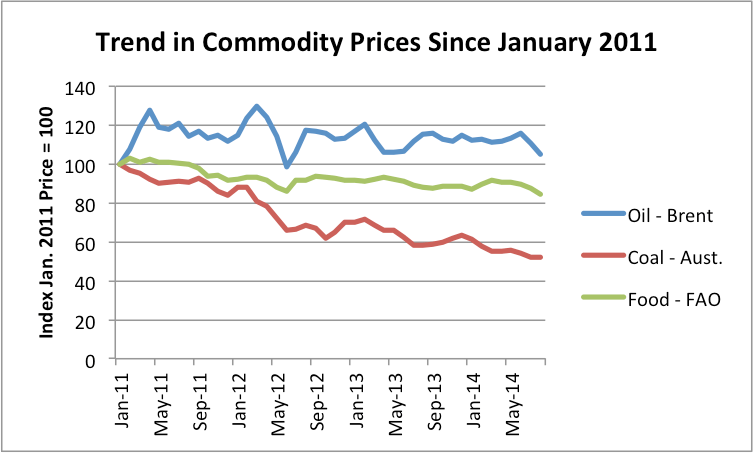

Figure 1. Trend in Commodity Prices since January 2011. Brent spot oil price from EIA; Australian Coal from World Bank Prink Sheet; Food from UN’s FAO.

Figure 1. Trend in Commodity Prices since January 2011. Brent spot oil price from EIA; Australian Coal from World Bank Prink Sheet; Food from UN’s FAO.

I would argue that falling commodity prices are bad news. It likely means that the debt bubble which has been holding up the world economy for a very long–since World War II, at least–is failing to expand sufficiently. If the debt bubble collapses, we will be in huge difficulty.

Many people have the impression that falling oil prices mean that the cost of production is falling, and thus that the feared “peak oil” is far in the distance. This is not the correct interpretation, especially when many types of commodities are decreasing in price at the same time. When prices are set in a world market, the big…

View original post 3,414 more words

NEWSLETTER: EVERYTHING IS CHANGED

Climate change will force us to ditch old paradigms. Enterprise will go on even if capitalism doesn’t.

(republished from http://Signals.avbp.net) to subscribe click here.

REPORTER AND AUTHOR NAOMI KLEIN RELEASES HER BOOK This Changes Everything: Capitalism vs. the Climate NAMING THAT CHERISHED PARADIGMS ARE BREAKING AS CLIMATE CHANGE ADVANCES AND THE PERFORMANCE OF CAPITALISM LOOKS EVER MORE SHODDY AS A WAY TO PROVIDE ESSENTIALS TO HUMANITY

Signals: Sooner or later the things we have been ignoring, brushing under the carpet, get named by brave individuals. Once a voice with enough authority and context gives it a name, it has to be dealt with. Naomi Klein, a brilliant reporter and sharp mind does just this in her new book.As she states clearly: Capitalism, since it was unshackled by the deregulation of the 1980s, has widened the gap between rich and poor. The top 3% held 55% of all wealth last year, up from 45% in 1989. The bottom 90% controlled 24.7% of wealth, according to statistics released this month by the Federal Reserve. The book represents a new wave of signals – bringing leaders, policy makers, thinkers and householders to confront cherished beliefs. Continue reading “NEWSLETTER: EVERYTHING IS CHANGED”

COURSE: The Community Finance Canvas

Length: 0.5-2 days

Purpose: Using the CANVAS approach teaches participants how to use the canvas to capture understanding of the financial flows in order to create the basis for a business plan

Why attend? Learning to use the CANVAS will give you a good tool to help take your initiative from idea to viable enterprise.

Main contents: The CANVAS method, how to unitize your offerings, finding alternative funding solutions and understanding membership

Includes: How to capture data for Business Plan, Manual and pro-forma business plan in Excel.

Creating a business model in a conventional way is daunting enough. But how can you create a viable financial model for a whole community, sustainable initiative or social enterprise? It IS possible as many initiatives up and running demonstrate, but you need to find a balance between achieving sustainability, creating the operations you want, and balancing the budget. The CANVAS is based on a participatory approach using a large board. The canvas method is designed as a way to work through possibilities to, for example, plug the leaks in your local economy, to grow from your Transition initiative into a Reconomy- initiative social enterprise or to make your Permaculture design into a thriving enterprise.

SPEAKING AT LOCALISED PRODUCTION DAY

PLACE: KTH ROYAL COLLEGE OF TECHNOLOGY STOCKHOLM

DATE: THURSDAY 18th SEPTEMBER

Around the globe, more and more people are living in urban areas. Also, the world population is growing and the need for areas for cultivation of food and livestock becomes greater. Even though cities are often said to have a great potential in minimizing climate effect, urban activities today generate significant amounts of greenhouse gases from activities such as energy generation, vehicles, industry and the burning of fossil fuels and biomass in households. Cities are also vulnerable to climate change that can change weather conditions, give rise to air pollution, raised sea levels, floods and so forth. Thus, there is a need for cities to both mitigate and adapt to climate change.

How could then a future city like Stockholm plan and allow for a substantial increase in local production of goods and services? How will the land use be distributed? What challenges does that impose to urban planners in planning for sustainable urban areas? Which key goods and services would be necessary to sustain locally? How can an urban area be planned to be attractive for its residents in their leisure time (since high mobility will be very expensive)?

Stephen Hinton will be presenting based on his experience in setting up an eco-village and with his work in Transition Towns in Sweden.

Slides KTH_RAKET

Links

Donella Meadows explains the problems from a system point of view.

http://www.donellameadows.org/archives/leverage-points-places-to-intervene-in-a-system/

The site Thwink goes further in analysing why sustainability does not catch on

Stephen Hinton’s site on maths for sustainability with the “famous” horse cart and oats problem

http://maths4sustainability.wordpress.com/2011/08/02/the-horse-and-oat-carts-problem/

Learn more about the eco-village (in Swedish)

And the collection of eco.village articles

Simulating the five P’s of the local economy

Length: 0.5-1 day

Length: 0.5-1 day

Purpose: learn about local economy and the role of currency by participating in a this simulation

Why attend? By taking a step back and simulating the local economy you can quickly gain deep insights into how the local economy works and could work with local currency. By creating your own currency you gain deep insights into how money works that you would otherwise only gain from literature study.

Main contents: Using a form of the complementary currency MINUTOS the simulation goes from a market with turnover assets of zero to creating functioning market, organisations, products and thriving citizens.

Learning: a separate group of “reporters” follows the simulation to gather data on how money and feelings, negative and positive, connect. They gather learning on essentials of money systems and collect statistics of how “economic growth” proceeds during the simulation.

Includes: The 5 P’s: place, people, products, payment mechanism and projects (organisations). Continue reading “Simulating the five P’s of the local economy”

THE MONOPOLY CODE: Secret alternative rules of Monopoly show how everyone can live in prosperity

I am utterly astonished. We have heard of the DaVinci code, but there is a MONOPOLY code. The secret rules of the game from the early 1900s show how, by changing the rules, everyone can live in prosperity. Continue reading “THE MONOPOLY CODE: Secret alternative rules of Monopoly show how everyone can live in prosperity”

Peace Day 21 September

Do check out what is happening on the 21 September in your Area.

I will be taking part in celebrations in Stockholm, Sweden, sharing the work being done by the Humanitarian Water and Food Award-

Come and join us at Debaser! (more details to come)

The video below explains the day.

See the video featuring Peace Ambassador Prem Rawat

And a final reminder.

Peace is a feeling. It is inside you. Peace starts now. In this moment

Water and Food Award Ceremony June 2014

Click on the image above to see the full broadcast of the event, to see who won and hear the panel and keynote speeches. Continue reading “Water and Food Award Ceremony June 2014”

Workshop: Simulating how the market based instrument flexible fees works

Aligning economic policy to physical constraints and people’s needs

Length: 0.5-2 days

Purpose: to simulate how flexible fees stimulate the development of the circular economy. This will give you insights into how economy, ecology and sustainability overlap and what can be done practically and on policy level in this age of constraints. Continue reading “Workshop: Simulating how the market based instrument flexible fees works”